Self-Service Tools

Reduce workload with handy self-service functions

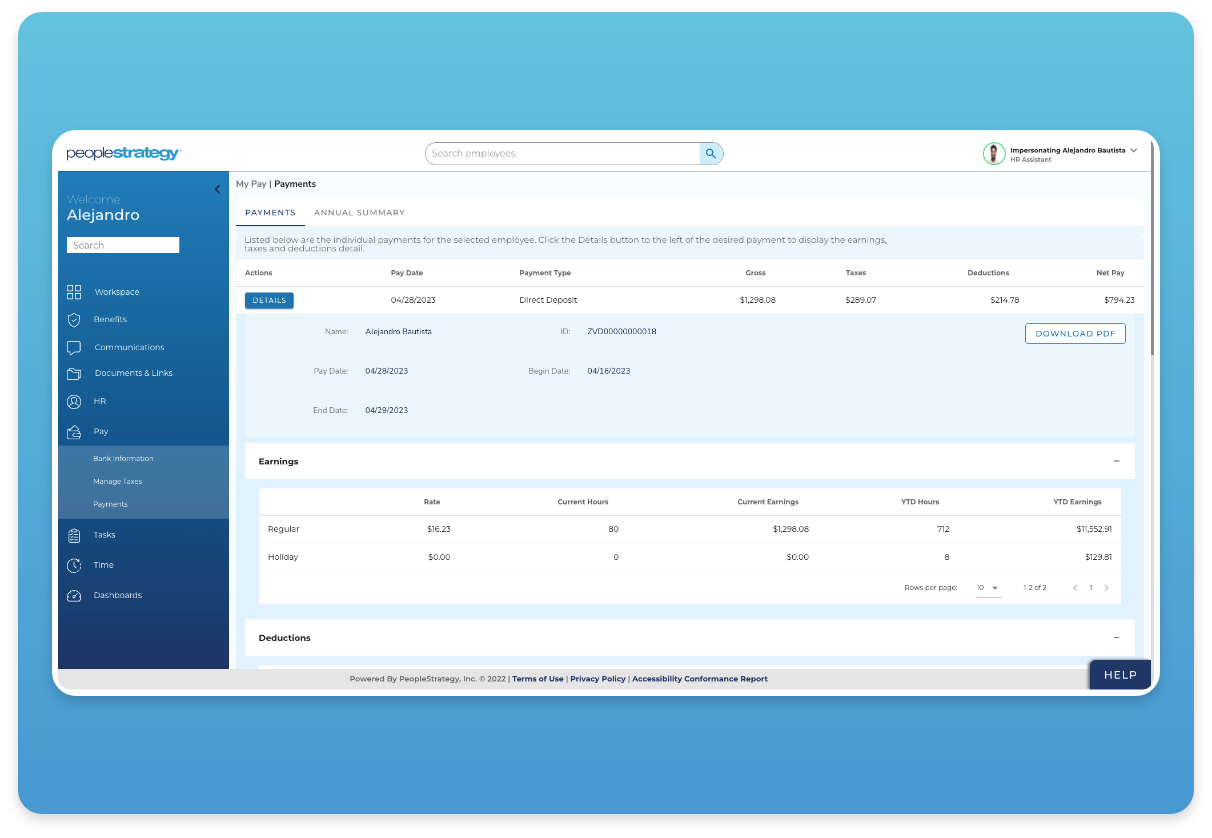

A great HR team helps employees manage their payroll and benefits packages, but this also takes time. Empower your employees and reduce workloads with our easy-to-use self-service function to check pay stubs, check benefits options, manage direct deposit accounts and more.

Tax Filing

Get your business ready for payroll tax deadlines

You can trust our tax services experts to assist with timely and accurate deposits of federal, state and local payroll taxes as well as for filing monthly, quarterly and annual returns. We also handle inquiries from tax agencies to free up your staff for bigger projects.

Year-End Services

Ready to assist with year-end filings

At year’s end, your HR team is busy wrapping up the forms needed for compliance and tax purposes. Give them a break with PeopleStrategy’s comprehensive year-end services. We review the data, then develop and deliver the necessary forms including W-2s and 1099s.